Discover how to lower customer service costs through smart tech, better training, and proactive engagement—without compromising quality.

Your customer service team is drowning in tickets, costs are soaring, and yet, customer complaints keep piling up.

Sound familiar?

Exceptional customer service isn’t just a nice-to-have – it’s a make-or-break factor for survival.

But here’s the kicker: as demands escalate, so do expenses. The real challenge isn’t just slashing costs; it’s doing so while keeping customers happy.

Impossible? Not at all.

This guide unveils proven strategies backed by hard data and industry insights to cut customer service costs without sacrificing satisfaction.

Ready to turn your support operation into a lean, loyalty-building machine? Let’s dive in.

Why Reducing Customer Service Costs is Critical to Business Success

Customer service isn’t cheap.

It’s often one of the priciest parts of running a business.

But here’s where it gets interesting: cutting costs carelessly can tank your customer loyalty – and your bottom line.

Let’s explore why strategic cost reduction matters and how it sets the foundation for everything that follows.

However, reducing these costs goes beyond mere expense cutting. According to Bain & Company’s research on loyalty economics, investing in loyal relationships with customers, employees, and partners yields substantial cost savings over time. Long-standing customers generate increasing profits with lower service costs and higher retention rates.

For example, in financial services, a modest 5% increase in customer retention can boost profits by over 25%.

This phenomenon occurs because loyal customers buy more, refer others, and have lower service demands. Vanguard’s selective client acquisition – rejecting even large investors likely to churn – exemplifies optimizing customer mixes for long-term profitability.

Similarly, Chick-fil-A’s focus on employee loyalty results in incredibly low turnover rates (5% vs. 35-40% industry average), stretching compensation budgets further by reducing hiring and training costs.

By building trust and loyalty, companies create a virtuous cycle that reduces expensive reactive service interactions while increasing revenue from satisfied repeat customers and efficient employees. Cutting service costs without carefully managing loyalty risks driving churn and dissatisfaction, negating savings with damage to brand equity. Knowing what drives costs is key to managing them. Here’s what to look for.

See how SingleView™ personalizes support and drives retention.

Key Factors That Contribute to Customer Service Costs

Before you can slash costs, you need to know what’s driving them. This section breaks down the culprits behind those hefty customer service bills. Understanding these factors is your first step to smarter savings – let’s get started.

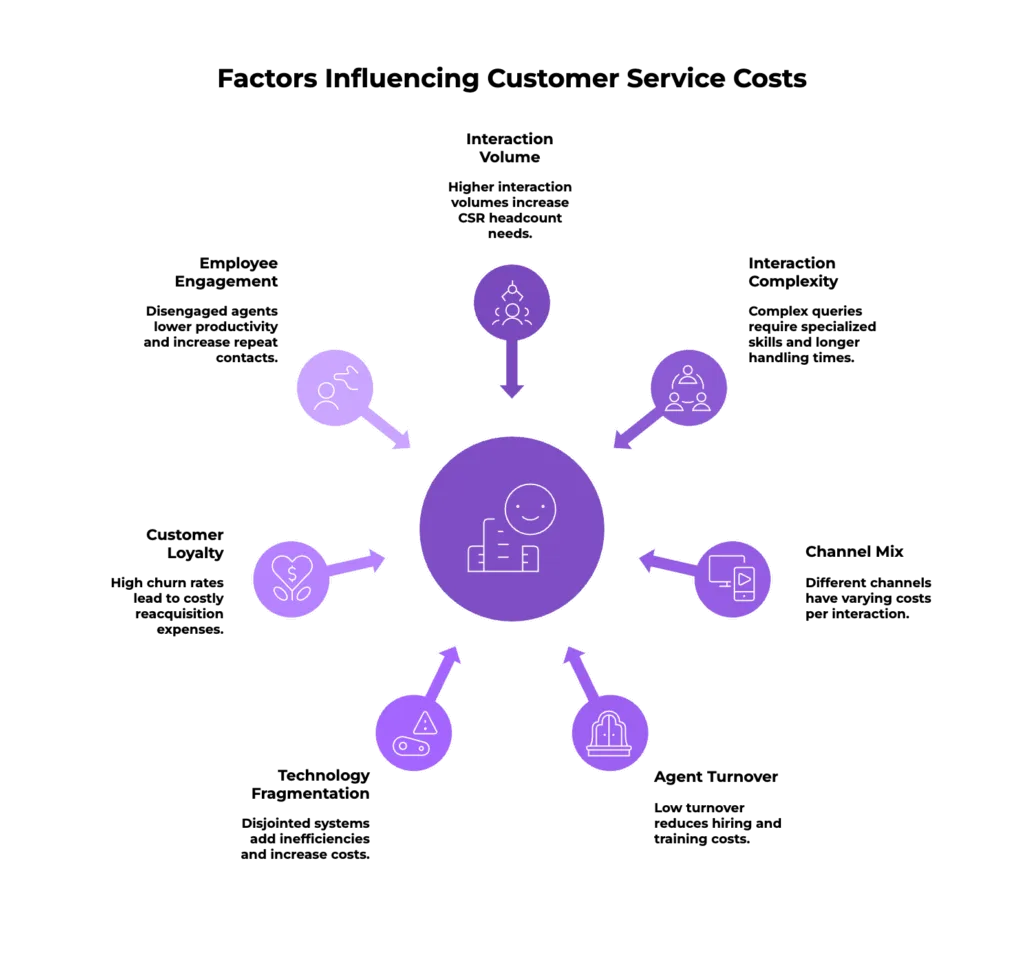

Several drivers influence customer service costs, ranging from operational to behavioral and technological factors:

- Volume and Complexity of Interactions: Higher volumes increase CSR headcount needs. Complex queries require longer handling times and specialized skills, inflating costs.

- Channel Mix: Assisted channels like calls are expensive ($5-$10 per interaction), whereas web-based self-service can cost less than $1 (Yankee Group). However, web self-service can paradoxically increase call volumes if information is ambiguous (Kumar & Telang).

- Agent Turnover: Chick-fil-A’s focus on employee loyalty results in incredibly low turnover rates (5% vs. 35-40% industry average), stretching compensation budgets further by reducing hiring and training costs.

- Technology Stack Fragmentation: Disjointed systems add inefficiencies and increase costs.

- Customer Loyalty and Retention: Incoming customers who churn quickly lead to costly reacquisition expenses.

- Employee Engagement: Disengaged agents have lower productivity and deliver poorer customer experiences, increasing repeat contacts.

Understanding these factors allows targeted cost control measures that optimize both the “front end” (interaction quality) and the “back end” (process and technology efficiency).

Now that we’ve mapped the cost drivers, you’re ready to act. Up next, we’ll roll out a full A-Z guide to tackle these challenges with precision and keep satisfaction soaring.

Kayako’s unified platform and AI automation can streamline operations.

How to Reduce Customer Service Costs: A-Z Guide

You’ve seen the why and the what – now it’s time for the how. This section is your playbook, packed with actionable steps to trim costs and elevate service quality. Let’s dive into the strategies that industry leaders swear by.

-

Audit and Measure Your Current Customer Service Expenses

Knowledge is power. Before slashing budgets, you need a clear picture of where your money’s going. Auditing your expenses lights the way – here’s how to do it right.

An essential first step is performing a comprehensive audit of all customer service-related expenses, both direct and indirect. This process involves:

- Mapping Cost Centers: Identify all points of customer interaction, including call centers, digital channels, social media support, and escalation teams.

- Data Collection: Gather historical data on interaction volumes, average handling times, agent costs, technology fees, training budgets, and turnover-related expenses.

- Segmentation: Categorize customers by type, value, and service needs to understand which segments drive disproportionate costs.

- Benchmarking: Compare your metrics to industry standards or competitors. For example, observe differences in call center volumes and costs relative to digital channel adoption.

- ROI Analysis: Evaluate return on investment for customer service tools, training initiatives, and loyalty programs. McKinsey’s telecoms eCare research shows a 20% call volume reduction with digital adoption.

This baseline measurement is vital for prioritizing which cost levers to pull and tracking the financial impact of subsequent improvements.

With your audit in hand, you’ve got the clarity to act decisively. Next, we’ll tackle that messy tech stack to boost efficiency even further.

2) Streamline and Consolidate Your Customer Service Technology Stack

A cluttered tech stack is a silent budget killer. Streamlining it can save time, money, and headaches. Let’s simplify your systems for maximum impact.

Overly complex technology landscapes increase maintenance costs, limit data flow, and frustrate both agents and customers. Many organizations harbor a patchwork of legacy call center software, multiple CRM systems, and fragmented digital tools. Leading practices in technology consolidation include:

- Integrated Platforms: Use omnichannel customer service platforms that unify telephony, chat, email, and social media support into one interface.

- Cloud Migration: Cloud-based solutions reduce capital expenditures and enable scalable, flexible deployment.

- Analytics and AI Integration: Embed analytics and artificial intelligence capabilities within the platform to measure customer interactions and inform optimizations.

- Open APIs: Ensure systems communicate seamlessly with billing, order management, and knowledge management systems.

Outro: A unified stack sets the stage for seamless support. Up next, we’ll see how unifying channels takes that efficiency to the customer level.

3) Unify Communication Channels for Seamless Customer Support

Customers hate jumping hoops between channels. Unifying them cuts costs and keeps satisfaction high. Here’s how to make it happen.

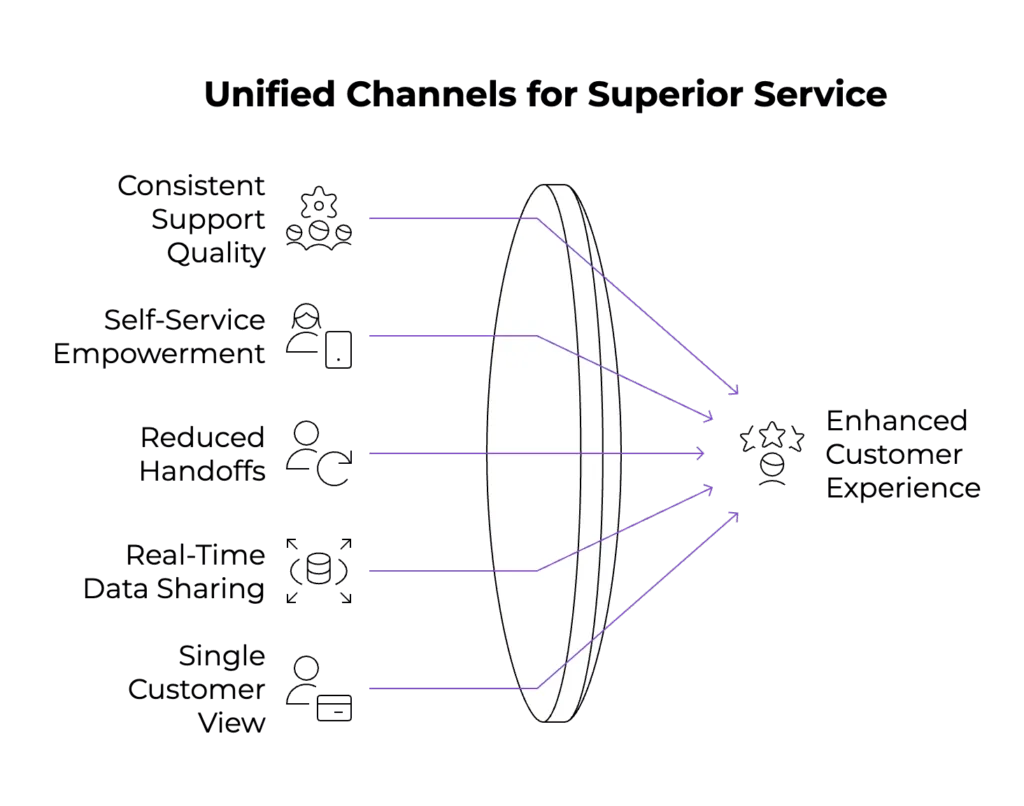

Customers today interact via diverse channels – voice calls, SMS, email, chat, social media, and increasingly, community forums. Disjointed experiences where information does not “follow” the customer frustrate users and increase repeat contacts.

McKinsey’s research underscores how unifying digital channels delivers higher satisfaction and significant cost reductions. Telecom companies using “eCare” strategies have reduced call volumes by 20% in less than a year while elevating Net Promoter Scores.

Unified channels deliver benefits including:

- Consistent support quality regardless of contact method

- Increased customer ability to self-serve on preferred channels

- Reduced internal handoffs and redundant inquiries

- Real-time data sharing and historical interaction context

A single customer view accessible across channels empowers agents and reduces resolution time.

Seamless channels mean happier customers and leaner operations. Next, let’s empower those customers with self-service solutions.

4) Implement Self-Service Solutions to Empower Customers

Why wait for an agent? Self-service saves money and delights customers – when done right. Let’s explore the winning formula.

Self-service technologies (SSTs) like web portals, mobile apps, and interactive voice response (IVR) systems offer customers convenience and reduce expensive assisted interactions. Empirical evidence from health insurance call centers shows self-service channels cost a fraction (e.g., $0.24 per interaction) of assisted channels ($5.50 per CSR call).

According to KPMG’s cost optimization playbook, technology investment that supports automation and self-service is a core lever for operational efficiency.

However, their effectiveness depends critically on the quality and clarity of information provided. Kumar and Telang’s study found:

- For unambiguous information (e.g., ID card requests, provider lookup), web portals reduced calls by 29%.

- For ambiguous or complex information (e.g., claims interpretation), calls increased by 66% after portal registration due to frustration (“aggravation effect”).

This highlights the importance of designing self-service portals with clear, searchable, and interactive content that minimizes confusion.

5) Leverage AI-Powered Tools: Chatbots, Knowledge Bases, and Automation

AI isn’t sci-fi: it’s your cost-cutting sidekick. From chatbots to automation, here’s how it transforms support.

Artificial intelligence is transforming customer service by delivering 24/7 support, instant responses, and personalized assistance at scale. Key AI applications include:

- Chatbots: Address routine queries instantly, freeing human agents for complex cases.

- Intelligent Knowledge Bases: Use machine learning to interpret customer intent and suggest relevant articles or next steps.

- Automation: Automate workflows such as ticket routing, case categorization, and follow-up reminders, reducing manual workloads and errors.

- Predictive Analytics: Anticipate customer issues and recommend proactive interventions.

Companies investing in AI report improved operational efficiency and customer satisfaction, especially when AI complements, rather than replaces, human service. A Gartner report predicts that by 2025, 80% of customer service organizations will use AI to enhance efficiency.

6) Optimize Call Routing, IVR, and Ticket Management Systems

Time is money – especially in call centers. Optimizing your systems cuts handling times and boosts results. Let’s dive in.

Optimizing infrastructure components like IVR menus and call routing logic can significantly reduce call handling times and improve first-contact resolution. Best practices include:

- Simple, intuitive IVR options prioritizing high-frequency requests

- Utilizing customer data to route calls to the most appropriate agent or specialist

- Implementing omni-channel ticketing systems to track and resolve issues efficiently

- Monitoring bottlenecks and continuously refining routing logic based on analytics

As call center costs are predominantly labor-driven, reducing average handling time (AHT) via these tools yields disproportionate savings. Research shows optimized routing can cut AHT by up to 15% (Forrester).

7) Train and Develop Customer Service Agents for Efficiency and Quality

Your agents are your frontline heroes. Training them well cuts costs and lifts satisfaction. Here’s the plan.

Technology alone cannot replace human judgment and empathy. Investing in agent skill development ensures high-quality, efficient interactions that reduce repeat calls. Effective training programs focus on:

- Product knowledge and problem-solving skills

- Communication and emotional intelligence

- Use of technology tools and data insights

- Time management to minimize handle times without sacrificing customer satisfaction

- Regular feedback cycles and coaching anchored in performance metrics foster continuous improvement. In fact, 75 % of contact centers plan to invest in omnichannel training by end‑2024, ensuring agents are proficient across phone, email, chat, and social channels .

8) Monitor Agent Performance and Focus on Reducing Handle Time

What gets measured gets managed. Tracking agent performance unlocks efficiency without skimping on quality. Let’s see how.

Continuous performance monitoring allows managers to identify trends and intervene proactively. Key metrics include:

- Average Handle Time (AHT), including wrap-up activities

- First Contact Resolution (FCR)

- Customer Satisfaction (CSAT) scores

- Adherence to schedules

Balanced scorecards ensure a focus on efficiency does not undermine quality. For instance, wrap-up activities can consume 20-30% of total call time and should be streamlined.

9) Foster Agent Well-Being and Retention to Lower Turnover Costs

Intro: Happy agents stick around – and save you money. Let’s explore how well-being slashes turnover costs.

Frequent turnover drives high recruiting, hiring, and training costs, threatening service quality. Research from loyalty leaders like Chick-fil-A highlights the power of investing in employee engagement, fair compensation, and performance transparency to reduce turnover dramatically. Supporting agent well-being through:

- Work-life balance programs

- Recognition and career progression opportunities

- Open communication channels

- Mental health and stress management initiatives

It results in more engaged agents, higher productivity, and lower operational expenses. According to Gallup report, Engaged teams can cut turnover costs by 25%

10) Use Proactive Customer Engagement to Prevent Issues and Reduce Volume

Why wait for complaints?

Proactive moves cut contacts and costs. Here’s how to stay ahead of the game.

Addressing customer needs proactively through data analytics and personalized communication reduces inbound contacts and churn risk. Examples:

- Machine learning detects early signs of service disruption or dissatisfaction

- Automated notifications about billing, outages, or service changes

- Proactive resolution offers that prevent escalation

Utilities leveraging such data-driven insights have successfully reduced churn and cost-to-serve. A Deloitte study found proactive engagement can lower contact volumes by 15%

Prevention beats reaction every time. Next, we’ll explore staffing options to stretch your budget further.

11) Explore Remote Staffing and Outsourcing Opportunities

Flexibility can be a budget’s best friend. Remote and outsourced staffing offer clever cost cuts – let’s check them out.

Remote work models and outsourcing can offer flexibility and cost advantages without compromising service.

Remote staffing extends talent pools, reduces real estate costs, and can be implemented with appropriate governance.

Outsourcing non-core or overflow interactions to specialist providers can smooth peak workloads cost-effectively. Both approaches require rigorous quality control and technology integration.

12) Continuously Capture Feedback and Adapt Strategies to Maintain Quality While Cutting Costs

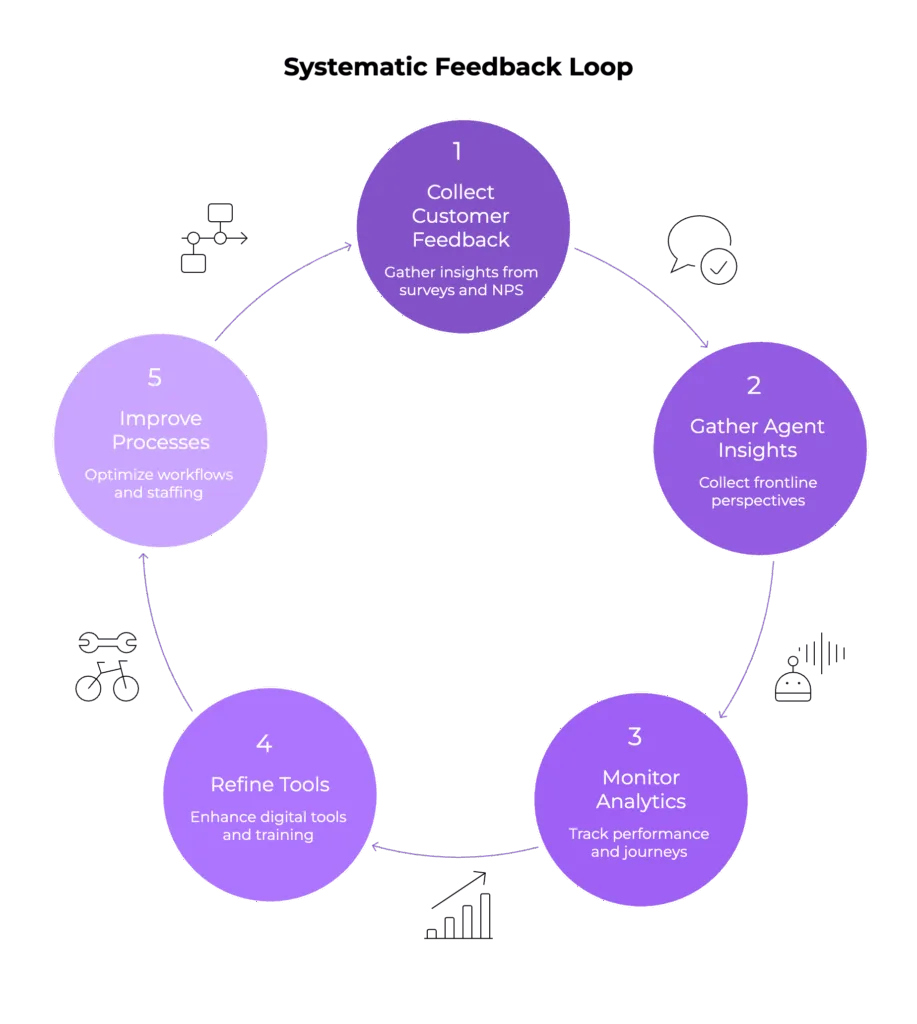

Sustainable cost reduction in customer service requires ongoing measurement and adaptation. Implement systematic feedback loops involving:

Sustainable cost reduction in customer service requires ongoing measurement and adaptation. Implement systematic feedback loops involving:

- Customer surveys and net promoter scores

- Agent feedback and frontline insights

- Analytics monitoring channel performance and customer journeys

Use this information to refine digital tools, training, processes, and staffing continually.

Conclusion

Reducing customer service costs while maintaining or improving quality is achievable through a strategic blend of loyalty focus, accurate measurement, technology rationalization, and talent management.

Empirical evidence shows that loyal relationships and clear, well-designed digital self-service reduce costs and churn.

However, pitfalls such as ambiguous web content and poorly trained agents can increase costs unexpectedly. Firms should think holistically – integrating digital channels, empowering both customers and agents, and leveraging AI judiciously – to optimize costs and create outstanding customer experiences. Building adaptive, data-driven customer service operations prepares companies not only to survive but thrive in the evolving service landscape.